Reduce the need for student loans

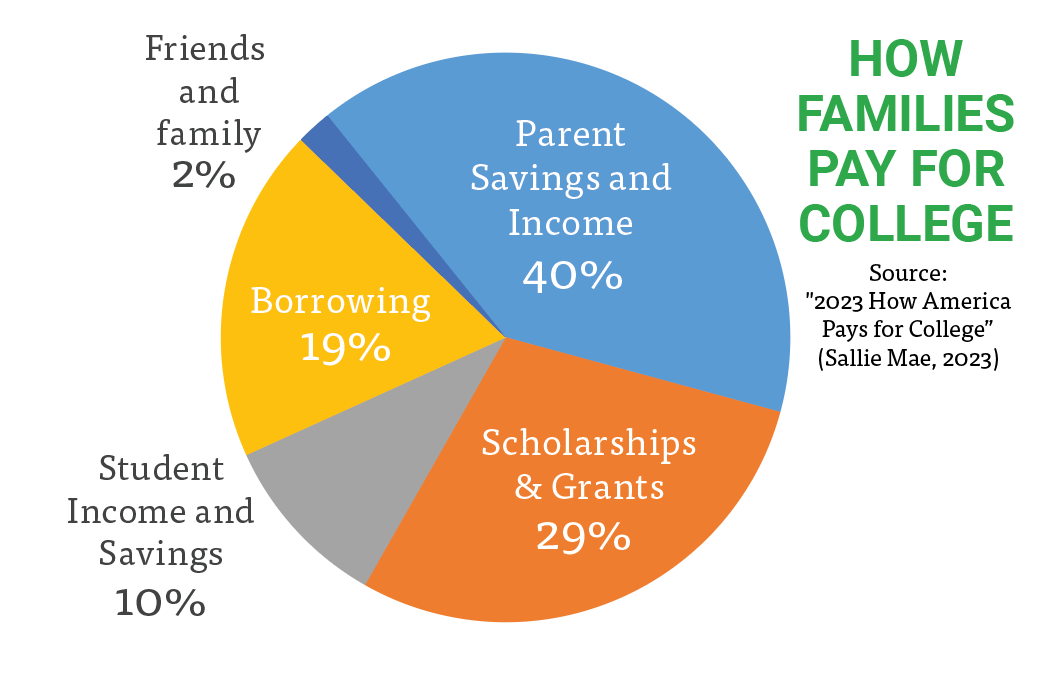

A recent nationwide survey of parents of college students found that less than half of costs were covered by parent income and savings. To bridge the gap, families continue to take on more debt to help pay for increasing college costs. Nationwide, total outstanding student loan debt is at an all-time high of $1.75 trillion. This debt can create a significant burden for young adults at the start of their careers.

A recent nationwide survey of parents of college students found that less than half of costs were covered by parent income and savings. To bridge the gap, families continue to take on more debt to help pay for increasing college costs. Nationwide, total outstanding student loan debt is at an all-time high of $1.75 trillion. This debt can create a significant burden for young adults at the start of their careers.

Making a plan to save while your student is still young can help reduce reliance on future borrowing. It’s also important to be realistic in setting savings goals. Too often families wait to save because the thought of paying for college can seem overwhelming. The reality is that most families will not be able to save enough to cover every future higher education expense, and that’s okay. Most families rely on a combination of efforts to pay for college, including financial aid, scholarships, loans, income, and savings.

Saving even a little helps a lot

A commitment to saving for higher education can be difficult to make, especially for young families with tight budgets. Ask parents of college students, however, and they’ll likely agree that any amount helps. Contributing regularly to your GET account can add up over time and help make college and career training more accessible and affordable for your student. Whether you save enough to cover tuition, provide for a semester abroad, or simply reduce the amount of future student loans, you’ll value the effort for years to come. Here are some ideas to get started:

![]() Skip the latte and brew your own coffee. That could free up over $1,000 per year to contribute to your higher education savings (Calculation assumes a $4.25 difference between the cost of a latte vs. brewing your own coffee; and an average of 250 working days in a year).

Skip the latte and brew your own coffee. That could free up over $1,000 per year to contribute to your higher education savings (Calculation assumes a $4.25 difference between the cost of a latte vs. brewing your own coffee; and an average of 250 working days in a year).

![]() The average income tax refund for the 2023 tax year was just over $3,000. Set that aside and give your savings a boost.

The average income tax refund for the 2023 tax year was just over $3,000. Set that aside and give your savings a boost.

![]() Just $5 a day for ten years could give you over $18,000 more to contribute to your college savings, and that doesn’t even include potential savings growth.

Just $5 a day for ten years could give you over $18,000 more to contribute to your college savings, and that doesn’t even include potential savings growth.

Is your student starting Kindergarten and you no longer have daycare expenses? Put that newly freed up expense in your GET account for their future education.

Start early and save

Enroll your newborn. Family members often like to recognize a child’s birth or special milestones of a baby’s first year with a lasting gift. Encouraging them to contribute to your child’s GET account is an ideal choice. Gifting is easy! Visit our gifting page to learn more.

Enroll your newborn. Family members often like to recognize a child’s birth or special milestones of a baby’s first year with a lasting gift. Encouraging them to contribute to your child’s GET account is an ideal choice. Gifting is easy! Visit our gifting page to learn more.

Did you know you can get a head start and open a GET account for future children? Just open an account during the enrollment period, naming yourself as both the account owner and student beneficiary. Once a child is born and has a Social Security Number, you can change the name of the student. If plans change, you can always use the GET account for yourself, or transfer it to another family member.

Plan ahead for your family. Another simple start to your college savings is to open one account that can be used to save for all of your future children. Make contributions over time then transfer Lump Sum amounts to new accounts that you open for each child later on. Families who start early have more time to contribute and watch their savings add up.

GET enrollment is open with a unit price of $123.76.

Learn More at the links below.