(February 15, 2023) - A few years ago, I bought my forever home. It’s not grand or elaborate by any means, but it is mine and exactly what I need for my retirement and beyond years. Purchasing this home was an exercise in simplicity and predictability because I had to consider what my needs would be when I’m 20+ years down the road and not what my life looks like at this specific time. With retirement savings in place and an adequate nest egg for emergencies and fun money, I knew I still had more savings goals to meet.

Webster’s defines saving as: "to put aside, to avoid unnecessary waste or expense, to economize, to spend less" – something we all do regularly or at least from time to time, for various reasons. It might seem easy enough, but at first, it might seem a hard commitment because it requires research, discipline, and patience. With a plan and a defined purpose, I followed a few simple steps to keep me on track for meeting my savings goals.

Be realistic with what you can save. Dr. Martin Luther King Jr. said, “you don’t have to see the whole staircase, just take the first step.” While these powerful words are attributed to Dr. King in the context of his faith, they serve as an important reminder to me whenever facing uncertainty. Life offers us many opportunities to take a first step, and we are prone to thinking we need more information, more assurance, more something before we do that. I didn’t want to be paralyzed by doing nothing because I could end up having nothing. Let your budget tell you how much to save – simply start there.

Set up automatic transfers. I set up three separate automatic transfers:

- To my savings account for when I might need immediate access to cash.

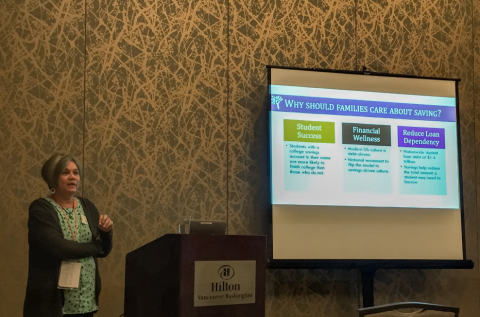

- To each of my grandchildren’s 529 accounts for their future education.

- To another savings vehicle for my future needs.

Automating provided the discipline I needed to keep the savings going.

Sell things you don’t need, and add the cash to savings. Although cliché, every dollar saved is a dollar not borrowed, so I started using a few online apps to sell things others might want. Instead of keeping the cash, I immediately put it into my grandchildren’s 529 accounts. These items held no value to me anymore, so these small deposits are growing their college savings accounts.

Save in a variety of ways. Any savings is valuable, but there are specific types of savings vehicles for specific goals, so I chose to save in a variety of accounts. Start with the amount you can save monthly and put portions into different accounts. The variety of options allows for a variety of outcomes, so diversifying is a smart savings strategy. If you simply save using one method, you miss the opportunities and possibilities of growth in other methods.

There’s no right or wrong way to save; only the decision to do it matters most. I’m encouraged that these small and simple steps will keep me on track, and by living through example, I am teaching and helping the next generation.

By Jackie Ferrado, Community Relations Manager, WA529

Jackie Ferrado is the Community Relations Manager with Washington State’s 529 College Savings Plans (WA529), which include the GET Prepaid Tuition Program and the DreamAhead College Investment Plan. Since 1998, tens of thousands of students have used more than $1.7 billion of their WA529 savings to attend colleges and trade schools in the U.S. and at least 15 foreign countries. Outside of work, Jackie enjoys baking, reading, and spending time with her three grandchildren.