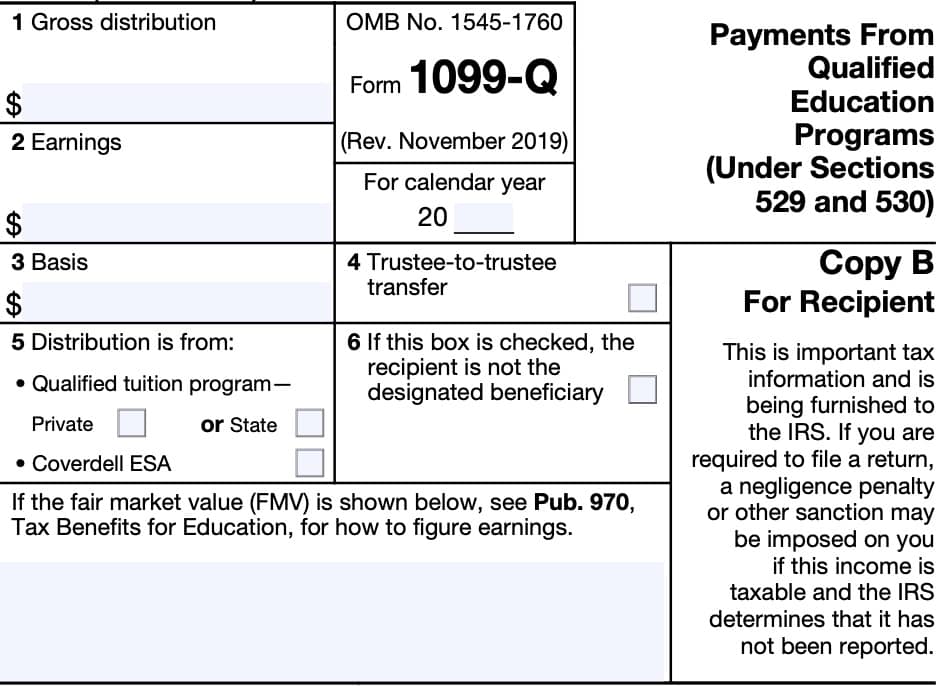

1099-Q FAQs

What it is, who gets, what to do with it.

-

A 1099-Q form is a record of funds distributed from a qualified tuition program (QTP or 529 plan) to an account owner, student beneficiary, or designated school. As a QTP, the GET Program is required by federal law to report this information to you. As a GET account owner or student beneficiary, you may receive a 1099-Q form if one of the following occurred in the previous tax year:

- We sent a refund check to the account owner or to the student (check recipient will receive the 1099-Q);

- We sent a reimbursement check to the account owner or to the student (check recipient will receive the 1099-Q);

- We paid the student’s school directly (student will receive the 1099-Q); or

- We sent a direct rollover to another 529 plan on your behalf (account owner will receive the 1099-Q). Note: in this case, you will see a checkmark in Box 4: “Trustee-to-trustee transfer.”

-

According to the IRS Website: “Earnings are not subject to federal tax and generally not subject to state tax when used for the qualified education expenses of the designated beneficiary, such as tuition, fees, books, as well as room and board.”

Additionally, according to IRS Publication 970: “The part of a distribution representing the amount paid or contributed to a QTP doesn't have to be included in income. This is a return of the investment in the plan. The designated beneficiary generally doesn't have to include in income any earnings distributed from a QTP if the total distribution is less than or equal to adjusted qualified education expenses.”

Also, “Any amount distributed from a Qualified Tuition Plan (QTP) isn't taxable if it is rolled over to another QTP for the benefit of the same beneficiary or for the benefit of a member of the beneficiary's family (including the beneficiary's spouse). An amount is rolled over if it is paid to another QTP within 60 days after the date of the distribution. Don't report qualifying rollovers (those that meet the above criteria) anywhere on Form 1040 or 1040NR. These aren't taxable distributions.”

Please consult a tax professional for details about your situation. We also encourage you to review the following resources:

-

These include the tuition, fees, books, computer technology, supplies, and equipment required for enrollment or attendance at an eligible college, university or other educational institution. They may also include some room and board costs. For details, review this summary and consult Chapter 8 of IRS Publication 970 Tax Benefits for Education, available on the IRS website.

-

- Box 1 shows the total funds distributed from your GET account.

- Box 2 shows earnings that could be subject to taxation if you didn’t use them for qualified education expenses as required by federal law.

- Box 3 shows the portion of the distributed funds that was paid (contributed) into your GET account. This equals the difference between Box 1 and Box 2.

-

The earnings could be taxable under the following circumstances:

- If any portion of the distributed funds were not used for qualified education expenses or were not rolled over into another QTP within 60 days for the same student beneficiary.

- The student beneficiary was changed to someone who is not an eligible family member of the original student beneficiary.

Other circumstances may apply. Consult a tax professional for more information. -

If your earnings are taxable, you must report the taxable earnings (box 2 on the 1099-Q form) on line 21 of IRS form 1040. If additional penalties apply, you also may need to complete IRS form 5329. Consult a tax professional for more information.

This information is based on current IRS regulations and is not to be considered tax advice. WA529 cannot provide tax advice or assistance. Any questions about your individual situation should be directed to a tax professional or IRS specialist.