The burden of educational debt on young adults

A recent survey of parents with college students revealed that less than half of college costs are covered by parents’ income and college savings. To make up the difference, many families turn to loans. Currently, total outstanding student loan debt in the U.S. has reached an all-time high of $1.77 trillion. This burden of debt often weighs heavily on young adults as they begin their careers.

The average borrower takes 20 years to repay their student loan debt.

The average monthly student loan payment is an estimated $500.

42% of borrowers are on the standard 10 year or less plan with fixed payments.

The average outstanding federal student loan debt per borrower is $37,853.

52.6% of indebted borrowers owe $20,000 or less in federal student loans.

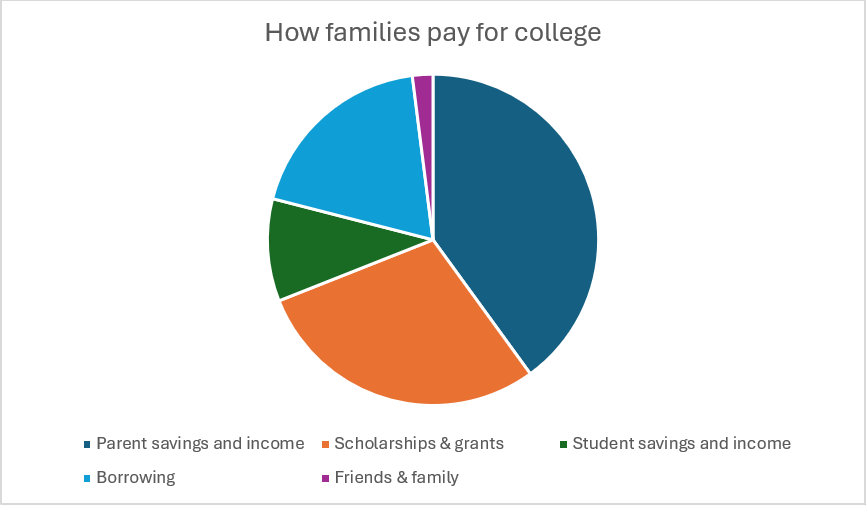

How families pay for college

Most families won’t be able to save enough to cover every expense—and that’s perfectly okay. Paying for college typically involves a combination of strategies, including financial aid, scholarships, loans, income, and savings.

Strategies for smart saving

By planning ahead and exploring all available resources, families can better prepare for the cost of higher education and avoid incurring student loan debt. Here are a few ways to get started.

- Set realistic savings goals, remembering that every little bit helps. Saving just $5 a day for ten years could add up to more than $18,000—without even factoring in potential growth from interest or investments.

- Look for little ways to save. For example, if you skip the daily latte and brew coffee at home, this small change could save you over $1,000 a year to invest in your education fund.

- Set aside your tax refund for college savings. The average tax refund in 2023 was just over $3,000. That could result in a meaningful boost.

Saving at every stage

Saving early is best, but it’s never too late to save for your child’s future.

Pregnant?

Open a 529 account with yourself as both the account owner and the student beneficiary, then transfer to your child later.

Have a Newborn?

Invite friends & family to gift to your child’s 529 account for future birthday, holiday, or graduation gifts.

Child in kindergarten?

Funnel previous daycare and/or caregiver expenses into a 529 account.

School-aged child?

Consider saving more aggressively with a combination of GET and WA529 Invest accounts to amplify savings.

Saving for multiple kids?

Start with a single 529 account and transfer lump sums from this account into individual ones for each child.

Remember, small, consistent efforts can make a big difference over time. Start saving today and pave the way for a brighter future.